SMART POWER SAVINGS: Get up to 11% p.a. on your Maya Savings

SMART POWER SAVINGS: Get up to 11% p.a. on your Maya Savings and Cash in via InstaPay for FREE!

- Promo period is from March 22-April 30, 2023 extended until May 31, 2023 as approved by DTI-FTEB

The promo is open to eligible Smart Postpaid users who are new or existing Maya users with upgraded accounts, who will receive an SMS or email from Smart with a unique code and instructions on how to activate up to 11% interest on their Maya Savings and cashback on their Instapay cash in transaction fee.

SMS sample:

Hi <Name>! Get up to a boosted 11% interest p.a. on Maya Savings exclusive to Smart Postpaid subscribers! Plus get up to P60 welcome reward for first time users, a FREE Maya card, and more! Just complete these steps after downloading the Maya App via <onelink>Step 1: Join Maya and upgrade your account

Step 2: Open a Maya Savings account, go to Missions and use your unique code <XXXXXXXXX> under “Smart Postpaid Exclusive” mission

Step 3: Pay min. of Php 1,000 for your Smart Postpaid bill or any other billOpen to existing and new Maya users using a Smart Postpaid account.

T&Cs apply. For more info, visit: smrt.ph/postpaidmaya. DTI#XXXXXX

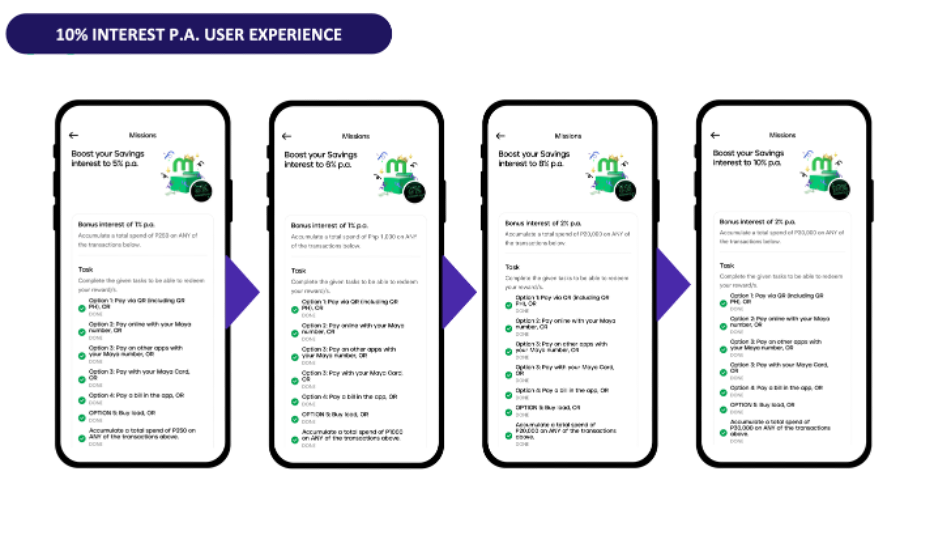

- Smart Postpaid users with upgraded Maya accounts must accomplish the following tasks below to qualify for the exclusive promo offers:

- Step 1: Input unique code received from SMART via SMS

- Step 2: Upgrade your Maya account and spend at least Php 1,000 on ANY of the following transactions done on the Maya Wallet within the promo period:

- Pay via QR

- Pay a bill in the app

- Pay via Mobile Number

- Pay with your Maya Card

Click here for the steps to upgrade your Maya account.

- Once the above transactions are completed, the Smart Postpaid user will be able to enjoy the following offers:

- Get up to 11% interest per annum on your first Php100,000 on Maya Savings.

- Maya Savings is offered to upgraded Maya Customers. Click here for the steps to upgrade your Maya account.

- Click here for the steps on how to open a Maya Savings account.

- Get up to P25 service fee cashback when you cash in at least P1,500 via Instapay to your Maya Wallet (1x per month only).

- Offer eligibility may take effect within 3-5 business days after the user enters a valid unique code (Step 1) in the Missions page

- Get up to 11% interest per annum on your first Php100,000 on Maya Savings.

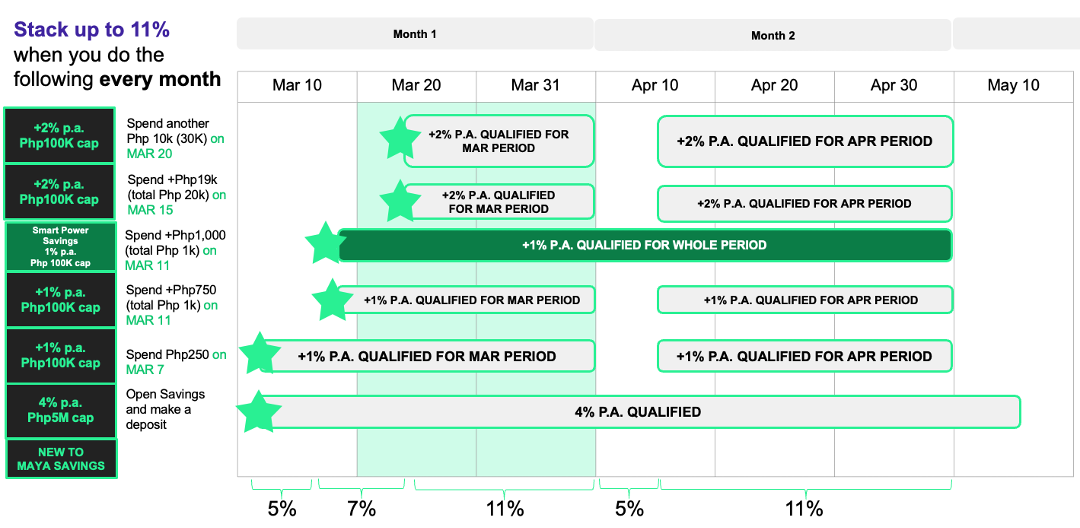

- All Maya Savings accountholders can enjoy a base interest rate of 4.0% p.a. on balances up to Php5M. Qualified Smart Postpaid users who will successfully spend min. Php 1,000 on ANY of the above-mentioned transactions can get to enjoy up to 11% interest per annum (p.a.) credited daily on up to P100,000 end-ofday deposit balance on their Maya Savings. Please see the breakdown below:

If a Maya Savings accountholder who just opened a Savings account did not complete any of the transactions above on the Maya Wallet, he/she will still be enjoying a 4% interest rate p.a. on his/her Maya Savings account.

But if the user just recently opened Maya Savings and transacted a total accumulate spend of Php250 within the month he opened a Savings account, he will get a total of 5% p.a. until March 31, 2023. If the same user transacted again and spent an accumulate of Php30,000 on April 1, he will get a total of 10% p.a. until April 30, 2023.

Example: User made the following transactions within the same month (i.e. March 7 to 31, 2023)

1st qualified transaction on March 7 = Php250 = user qualifies for a total of 5% p.a. (+1% p.a.) from March 7 to 31, 2023

2nd qualified transaction on March 8 = Php750 = user qualifies for a total of 6% p.a. (+1% p.a.) from March 8 to 31, 2023

3rd qualified transaction on March 10 = Php19,000 = user qualifies for a total of 8% p.a. (+2% p.a.) from March 10 to 31, 2023

4th qualified transaction on March 11 = Php10,000 = user qualifies for a total of 10% p.a. (+2% p.a.) from March 11 to 31, 2023

Total / accumulate spend transactions within March 7 to 31, 2023 = Php30,000

Any amount transacted within March 7 to 31, 2023, will fall under the Month 1 accumulate spend

Any amount transacted within April 1 to 30, 2023, will fall under the Month 2 accumulate spend

- Please see below sample scenarios on qualification for reference:

- In case of (including but not limited to) user-triggered mobile number change, the total amount of qualified transactions will be reset to zero (Php 0) and the user has to transact at least Php 1,000 worth of qualified transactions again to qualify for the promo.

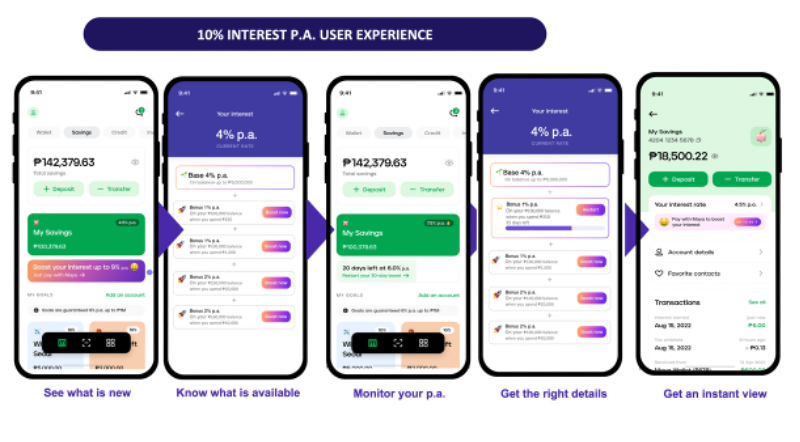

- Accountholder will be able to see his/her qualification duration for the bonus interest rate on the Savings dashboard or on the Missions screen the same day the qualified transaction was made.

Note: Make sure your app is updated to the latest version so you can track your boosted interest. You can check your Missions anytime to see your progress. For some users, you won't immediately see your Savings interest screen but your bonus interest will still be credited to your account every day after making a qualified transaction.

- Your base interest rate and bonus interest rate will be reflected on your transaction history the next day as follows:

Interest Rate New & Existing Depositors Reflected As 0 Base Rate 4% p.a. 1. Base interest

2. Tax withheld1 Bonus Interest Rate from Php250 accumulate spend 1% 1. Bonus interest

2. Tax withheld2 Bonus Interest Rate from Php1,000 accumulate spend 1% 3 Bonus Interest Rate from Php1,000 minimum spend (exclusive to eligible Smart Postpaid subscribers) 1% 4 Bonus Interest Rate from Php20,000 accumulate spend 2% 5 Bonus Interest Rate from Php30,000 accumulate spend 2% - For an updated table of our interest rates, check our Maya Savings Terms and Conditions

- Bills pay transactions made at the following billers are excluded from the promo:

- "Donation" category billers

- "Others" category billers

- "Payment Solutions" category billers

- And other billers prone to promo abuse

- QR transactions made at the following merchants are excluded from the promo:

- Maya Business App (formerly called PayMaya Negosyo) merchants

- "Donation" category merchants

- "Gambling" category merchants

- Maya users with merchant accounts and those under Maya Negosyo and Maya Business Manager (formerly PayMaya Business Manager or PBM) are disqualified from participating in this promo.

- Maya payments (Maya number, Maya QR or Maya card) made to Maya Negosyo and Maya Business Manager merchants or submerchants are not qualified for the promo.

- Payments made to or purchases of cash equivalent instruments, financial institutions, financial assets, insurances, ATM withdrawals, gambling/gaming chips, and other quasi cash transactions are also not qualified for the promo.

- Maya payments (Maya number, Maya QR or Maya card) or transactions made to merchants within the crypto space are not qualified for the promo. (e.g PDAX cash-in, other VASPs to be enabled where Maya payments are accepted, etc.)

- Select users eligible for other targeted promos may no longer be eligible for this promo at the discretion of Maya.

- Minimum cash in amount is P1,500 to qualify for the cashback voucher. To qualify, follow the following steps:

- Open your bank app or GCash e-wallet and transfer via InstaPay

- Choose PayMaya/Maya Wallet and enter your wallet’s mobile number

- Open Maya to check that you’ve received your money in the app

- Cash in amount required is subject to source bank's minimum amount requirement.

- Qualified users will receive up to P25 cashback per voucher on their InstaPay fees when they cash in to their Maya e-wallets via InstaPay within the promo duration.

- Users may avail of the promo only once (1x) per month during the total promo duration.

- The maximum reward users will receive is equivalent to their banks’ or e-wallet's Instapay fee. See fee table below as of December 2022 (InstaPay fees are dictated by partners and may change at their discretion during the promo period. However, only the fees below will be rebated for this promo):

- The following transactions are not included in the promo and will not be rewarded

- Transferring of funds to other banks and e-wallets via InstaPay

- Transferring of funds into the Maya e-wallet via online linked account directly within the Maya app

- Cashing in via over-the-counter (OTC) channels

- Cashing in via other e-wallets not included in the list above

- Only transactions from banks and GCash e-wallet with existing InstaPay cash in fees will be qualified for the cashback. Transactions from banks with waived fees are not qualified from the promo.

- This promo is applicable only to unique and valid Maya Consumer accounts registered under a unique mobile number and mobile device. User will not be eligible to participate in the promo if he/she creates multiple accounts using one mobile device. Maya reserves the right to withdraw and/or expire wrongfully rewarded cashbacks or vouchers regardless if claimed or unclaimed by the user.

- Maya users with duplicate accounts or who are blacklisted cannot participate in this promo. Maya reserves the right to cancel or withdraw the prize or benefit if proven to be a duplicate account or participant is blacklisted.

- Maya reserves the right to refuse the awarding of cashback or rewards to accounts that are proven to be invalid or fraudulent (i.e. abuse of system or weakness in the promo to win prizes or receive benefits).

- Maya reserves the right to withdraw cashback or rewards to invalid accounts even if the user has already received the cashback or benefit.

- Should the qualified transaction be cancelled or declined, whether the cancellation is customer- or biller-initiated, Maya reserves the right to withdraw the cashback or rewards equivalent to the cancelled payment transaction, even if the cashback has already been credited. Maya reserves the right to debit any points/cash reward credited from your balance. If your balance is insufficient to cover the amount to be withdrawn at the time of withdrawal, Maya reserves the right to debit the balance not withdrawn when your balance is sufficient.

- Maya users with merchant accounts and those under Maya Business App (formerly known as PayMaya Negosyo) are disqualified from participating in this promo.

- Any reward credited to the qualified user shall be deemed final unless the customer notifies Maya of mistake in crediting, such as, but not limited to: incorrect reward credited or uncredited reward, within 30 calendar days from the end of the promo period.

- The customer must notify Maya for any complaints regarding the promo. The decision of Maya on the complaint with concurrence of DTI-FTEB shall be considered final. For clarifications and complaints relative to this promo, (+632) 8845-7788 or email support@maya.ph.

- Maya users who have exceeded their aggregate limits may not receive their prize or cashback on time. The prize or cashback can only be credited the following month or once a user’s account balance is once again within the allowable limits – Php 50,000 for starter accounts and Php 100,000 for upgraded accounts.

- Promo participants must agree to be interviewed and featured in announcements to be made by Maya regarding the promo in any of the following channels: website, social media, print and online media.

- Videos and photos of participants may be used only for promotional ads related to this campaign.

- Only Consumer accounts are qualified for this promo. Maya users with Maya merchant accounts and Maya Center agents are disqualified from participating in this promo.

- In case of disputes regarding accountholder's eligibility for the promo, coverage of dates, fulfillment, Maya's decision shall prevail, in concurrence with DTI.

DTI Fair Trade Permit No. FTEB-162898 Series of 2023

Deposits are insured by PDIC up to P500,000 per depositor. Maya Bank, Inc. is regulated by the Bangko Sentral ng www.bsp.gov.ph

Partner Merchants

Meet the Maya community

Check out the brands that offer the Maya experience

About Maya

Maya is the only end-to-end digital payments ecosystem enabler in the Philippines with platforms and services that cut across consumers, merchants, communities, and government. Through its enterprise business, it is the largest digital payments processor for key industries in the country including "everyday" merchants such as the largest retail, food, gas, and eCommerce merchants, as well as government agencies and units.

No Maya yet? Download it below for free!

.png)

.png)

.png)

.png)