- Home

- Services

- User Guide

- All Guides

- Account Limits

- Activate Virtual Card

- Bank Transfer

- Bills Payment

- Cash In

- Claim Remittance

- Create an Account

- Email Verification

- Gaming

- Get a Maya Card

- Link Physical Card

- Mobile Prepaid Load

- Mobile Data

- Pay using Maya Card

- Pay with Maya online

- Pay with QR

- Save

- Send Money

- Funds

- Travel with Maya

- Upgrade Account

- Use Abroad

- Deals

- Store

- Partner Merchants

- Stories

- About Maya

- Help & Support

- Contact Us

- Home

- Services

- User Guide

- All Guides

- Link Physical Card

- Account Limits

- Mobile Data

- Activate Virtual Card

- Mobile Prepaid Load

- Bank Transfer

- Pay using Maya Card

- Bills Payment

- Pay with Maya online

- Cash In

- Pay with QR

- Claim Remittance

- Create an Account

- Save

- Send Money

- Email Verification

- Send Money via @Username

- Funds

- Travel with Maya

- Gaming

- Get a Maya Card

- Use Abroad

- Deals

- Help & Support

- Store

- Partner Merchants

- Stories

Maya Funds

- User Guide

- Funds

Start your investment journey with

only ₱50

Become an instant investor with 13 local and global funds to choose from

Open to select users with upgraded Maya accounts using the latest version of the app. Investment funds will buy from the featured companies. Fund composition is subject to change. All trademarks, logos, and brand names are property of their respective owners.

You're ready to invest in

just 3 steps

Start investing

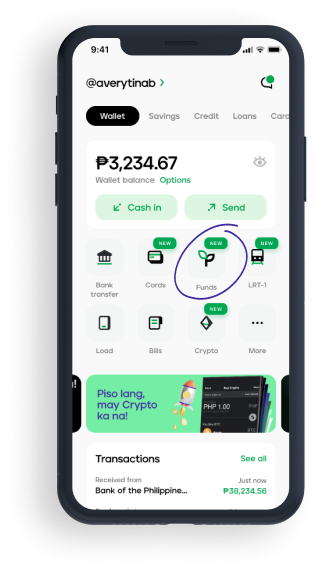

Step 1

Log in to Maya and tap Funds

Step 2

Set up your investment profile – this helps us give you personalized fund recommendations!

Step 3

Choose a fund that suits your profile & start investing for as low as ₱50

Get access to Maya Funds for free

Simply upgrade your Maya account using 1 valid primary ID. Already upgraded? You can start investing for as low as ₱50 and enjoy absolutely zero transaction fees.

How to upgrade

Why you’ll love

Maya Funds

Invest as little as ₱50 in local and global funds

You don’t need much to get started with funds invested in some of the most popular companies like Google, Apple, Tesla, Ayala Land, SM and more!

Learn more.png)

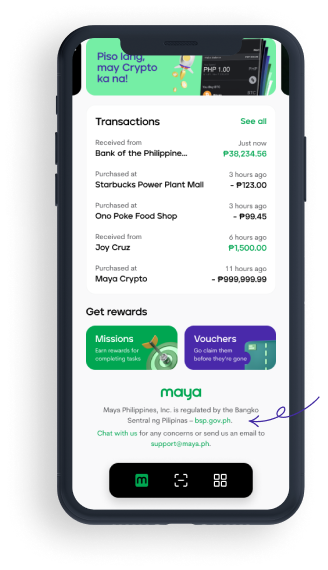

Do everything with one app

Cash in, invest, cash out, and use your potential earnings for bills, shopping, and other day-to-day money needs – all on the Maya app

Keep all your earnings

Cash in and out for free* and enjoy zero transaction fees when you invest with Maya

*At any of our select 120,000+ partners

Invest without worries

Maya and its partners are regulated by the BSP and SEC to make sure your investments are safe and secure

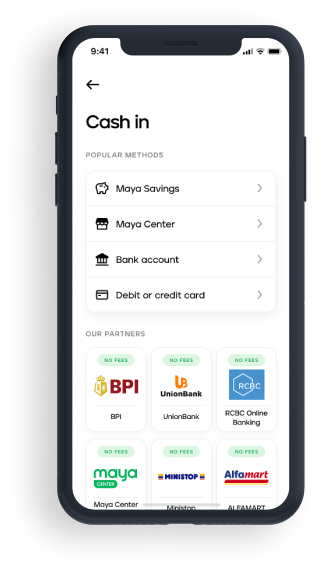

Funding your account

is quick and easy

- via Investa

- via Seedbox

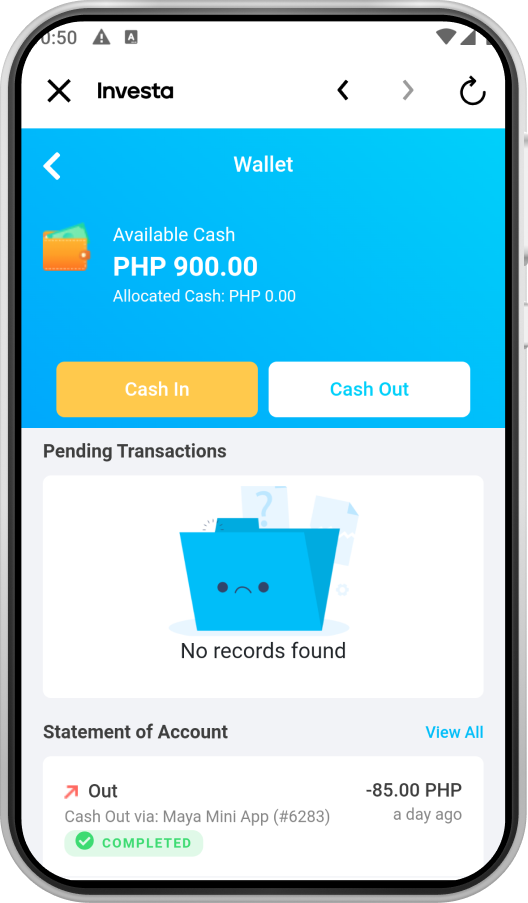

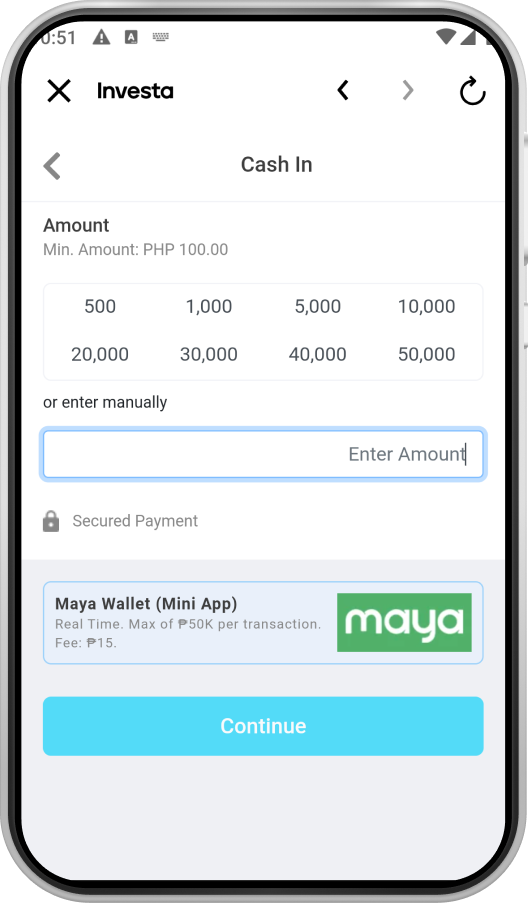

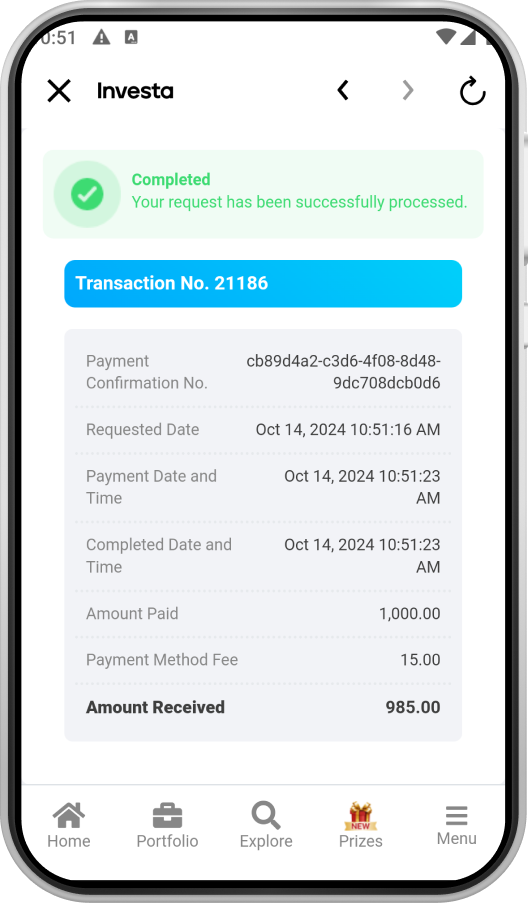

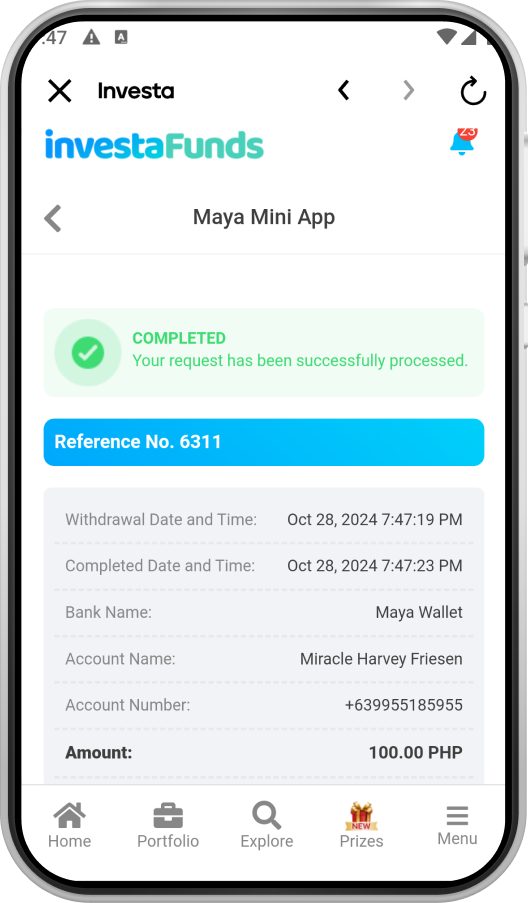

1 Open Investa and tap Cash In

2 Tap or enter the amount you want to cash in then tap Continue

3 Start buying stocks immediately

1 Fund your account directly using your Maya Wallet

Cash out in just a few taps

- via Investa

- via Seedbox

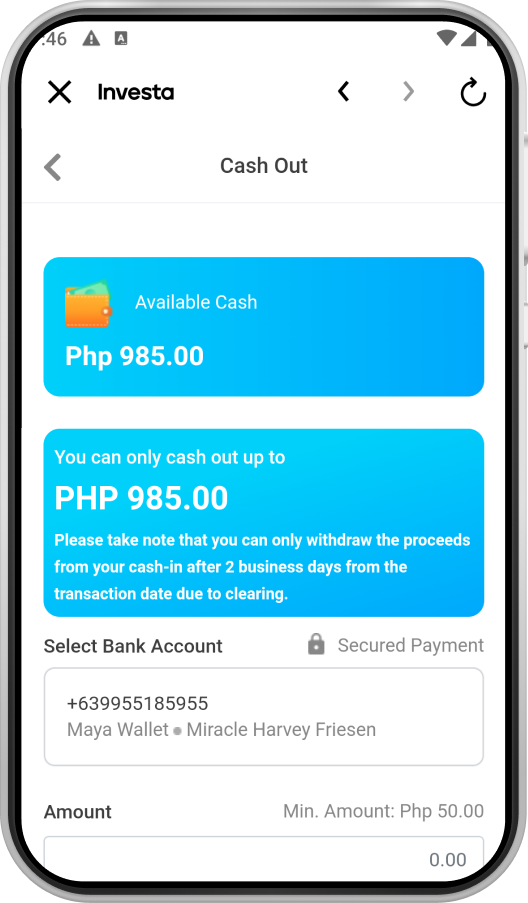

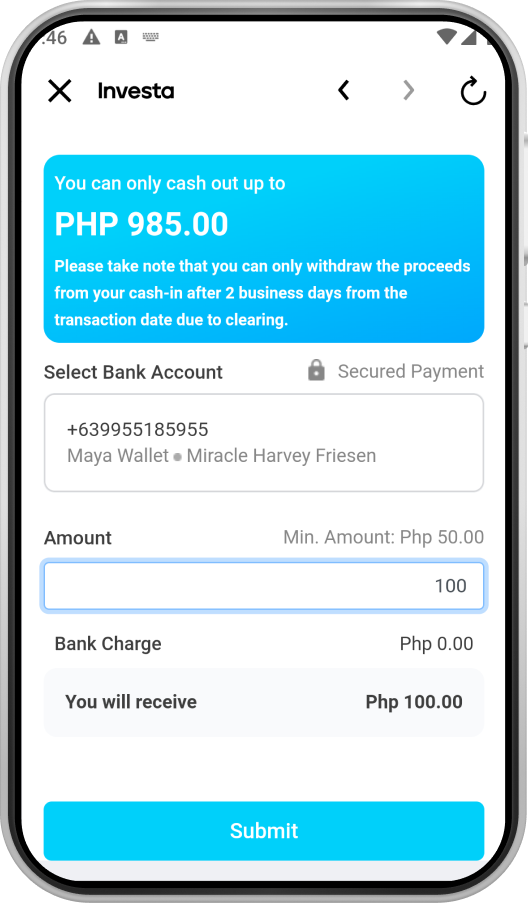

1 Go to the Cash Out page

2 Enter the amount you want to cash out

3 Receive the cash out amount in your Maya Wallet

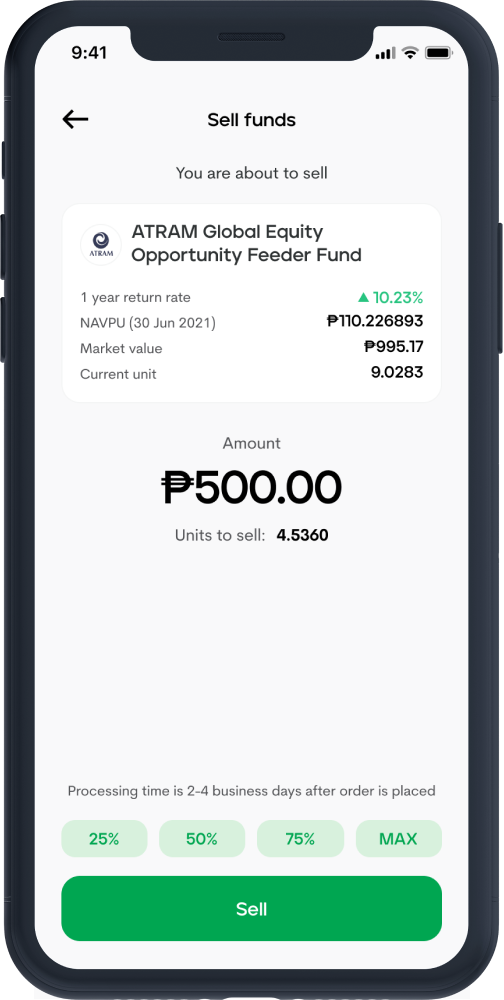

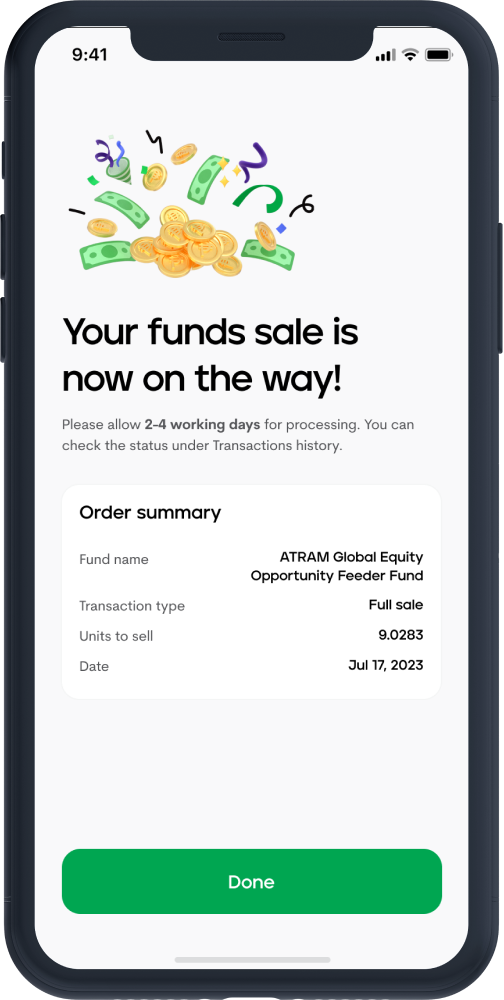

1 Choose the fundyou want to sell

2 Enter amount you want to sell

3 Receive your earnings in your Maya Wallet in 2-4 working days

Build your investment portfolio

with a wealth of options for as low as ₱50

Find local and global funds to invest in, including 3 brand new

funds exclusive to Maya Funds at launch

ATRAM Peso Money Market

The objective of the fund is to maximize income and achieve higher returns compared to regular bank deposits while preserving capital by investing in a portfolio of very liquid, fixed-income instruments and maintaining an average portfolio duration of 1 year or less.

Know more here

ATRAM Total Return Peso Bond

The fund seeks to maximize total return by investing all or substantially all of its assets in a balanced collective investment scheme that invests globally in equity, debt, and short-term securities, of both corporate and government issuers.

Know more here

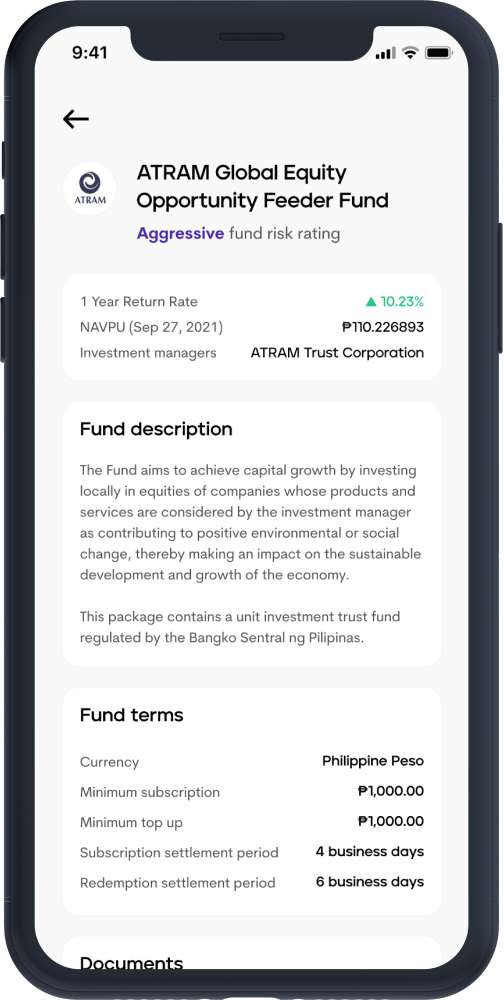

ATRAM Global Equity Opportunity

The fund seeks to achieve long-term capital appreciation by investing all or substantially all of its assets in an equity collective investment scheme that invests principally in equity securities in markets throughout the world including major markets and smaller emerging markets.

Know more here

ATRAM Philippine Sustainable Development & Growth

The fund aims to achieve capital growth by investing locally in equities of companies whose products and services are

considered by the investment manager as contributing to positive environmental or social change, thereby making an impact on the sustainable development and growth of the economy.

ATRAM Global Infra Equity Feeder Fund

The fund seeks to achieve long-term capital appreciation by investing all or substantially all of its assets in a collective investment scheme that invests principally in equity securities of companies engaged in the infrastructure sector worldwide.

Know more here

ATRAM Global Healthcare Feeder Fund

The fund seeks to achieve long-term capital appreciation by investing all or substantially all of its assets in a collective investment scheme that invests principally in equity securities of companies throughout the world that are involved in the design, manufacture, or sale of products and services used in health care, medicine, or biotechnology.

Know more here

ALFM Money Market Fund

The fund aims to achieve preservation of capital and stable income by investing in a diversified portfolio of Philippine Peso denominated short-term fixed income and money market instruments.

Know more here

ALFM Philippine Stock Index Fund

The fund aims to track the performance of the Philippine Stock Exchange Composite Index (PSEi). The fund shall substantially invest in stocks comprising the PSEi using the same weights as in the index.

Know more here

ATRAM Philippine Equity Smart Index Fund

The fund is designed to generate excess returns compared to its benchmark through an enhanced index approach, combining the elements of passive and active management.

Know more here

ATRAM Global Consumer Trends Feeder Fund

The fund seeks to achieve long-term capital growth by investing all or substantially all of its assets in a collective investment scheme that invests globally in equities of companies that are predominantly engaged in the design, production or distribution of products and services related to the discretionary consumer needs of individuals.

Know more here

ATRAM Global Financials Feeder Fund

The fund seeks to achieve long-term capital appreciation by investing all or substantially all of its assets in an equity collective investment scheme that invests mainly in equity securities of companies predominantly involved in providing financial services.

Know more here

ATRAM Global Technology Feeder Fund

The fund seeks to achieve long-term capital appreciation by investing all or substantially all of its assets in a collective investment scheme that invests principally in equity securities of companies throughout the world that derive or benefit significantly from technological advances and improvements.

Know more here

ATRAM Global Allocation Feeder Fund (PHP Class)

The fund seeks to maximize total return by investing all or substantially all of its assets in a balanced collective investment scheme that invests globally in equity, debt and short-term securities, of both corporate and government issuers.

Know more here

Sun Life Prosperity World Income Fund

The Sun Life Prosperity World Income Fund gives you the best of both worlds in a single fund: access to a variety of global assets in a single fund using Philippine pesos and potential monthly cash payouts.

This is a multi-asset feeder fund that invests 90% of its net assets in a Target Fund1 managed by BlackRock®, one of the world’s largest asset management companies.

Know more hereMeet our partners

Your investment is safe with Maya

We’ve partnered with some of the most reputable financial institutions in the country to make sure your investment is in capable hands

.png)

ATRAM is the first standalone trust corporation in the Philippines and is established as the leading independent asset manager within the country

.png)

BIMI is wholly-owned subsidiary of the Bank of the Philippines Islands and was incorporated as Ayala Investment Management, Inc. to principally engage in the business of managing an investment company

.png)

Seedbox was established in the Philippines in 2016 and is the first digital marketplace for financial products in the country

InvestaFunds is an online mutual fund distribution platform owned and operated by InvestaFinancial Inc - a corporation duly organized and existing under Philippines Law and is regulated and licensed by the Securities and Exchange Commission as a mutual fund distributor

What is Maya Funds?

Maya Funds is a new feature for upgraded Maya users that lets you invest in Unit Investment Trust Funds (UITFs) and Mutual Funds (MFs). You can rely on a secure and accessible fund investing experience thanks in part to our partnership with Seedbox Philippines, a digital marketplace for financial products.

You can use Maya Funds to access products by ATRAM Trust Corporation and BPI Investment Management, Inc. (BIMI), both leaders in the fund management industry. We’ll have more products added in the future.

What features can you enjoy with Maya Funds?

Maya Funds is suitable for both new and experienced investors. Once you create an account, you can:

- Subscribe, top up, and redeem your fund investments

- Fund your investments using your Maya Wallet

- Deposit money to your Maya Wallet from the investments you sell

- View your latest investment balances

- View your investment transaction history

- Get instant access to new investment products

- See the latest price and investment performance of each product

Who are the product/fund providers on Maya Funds?

The fund products you’ll find on Maya Funds are provided by ATRAM Trust Corporation (ATRAM) and BPI Investment Management Inc (BIMI). Both are trusted leaders in the fund management industry in the Philippines.

ATRAM Trust Corporation is the first standalone trust corporation in the Philippines. It received its license to operate in October 2016 from the Bangko Sentral ng Pilipinas (BSP). For more on ATRAM, visit atram.com.ph/about-us/who-we-are.

BIMI is a wholly-owned subsidiary of the Bank of the Philippines Islands and was incorporated on July 30, 1974 as Ayala Investment Management, Inc. to principally engage in the business of managing an investment company. For more on BIMI, visit pamifunds.com/about-pami-funds.

Is my money safe with Maya Funds?

Yes. Like our banking products, Maya Funds is licensed and regulated by the Bangko Sentral ng Pilipinas.

In addition, using Maya Funds means you are protected by the rules indicated in the fund product’s Declaration of Trust (DOT). The DOT is the BSP-approved operational manual that you must agree to before investing in the fund. You can get a copy of the DOT anytime from the product’s page in Maya Funds.

Who can use Maya Funds?

To start using Maya Funds, you must fall under the following criteria:

- Must have an upgraded Maya account

- Must have a verified mobile number

- Must be 18 years old or more

- Must NOT be a US Person

What do I need to do before investing with Maya Funds?

Before you can start, you’ll first need to provide some information. On the Wallet dashboard of the Maya app, tap ‘Funds.’ From there, you’ll be asked to do the following:

- Declare if you are a US Person

- Upgrade your account and verify your email address (if applicable)

- Answer the Suitability Assessment/Risk Profiling Questionnaire to receive your Risk Profile

What is the Risk Profiling/Suitability Assessment Questionnaire and can I skip it?

The Risk Profiling/Suitability Assessment Questionnaire determines your willingness and ability to take risks – your risk profile, in short. Your investment knowledge, experience, and financial capacity are some of the many factors in determining your risk profile.

Maya Funds will recommend appropriate investment products according to your risk profile. Everyone must first complete the questionnaire before they can start using Maya Funds.

What products can I invest in with Maya Funds?

There are currently 13 fund products available in Maya Funds. For each fund’s complete product information, you can download the Key Investment and Information Disclosure Statement (KIIDS) by selecting your preferred fund and tapping the ‘Performance’ tab in the Maya Funds dashboard.

Are there fees in investing with Maya Funds?

Maya will not charge you any transaction or hidden fees for using Maya Funds. However, fund managers (ATRAM & BIMI) will charge management/trust fees, which range from 0.50% p.a. to 1.75% p.a. depending on your preferred UITF. Trust fees, meanwhile, are already added in the computation of a UITF’s NAVPU.

Maya Customer Hotline: (+632) 8845-7788

Domestic Toll-Free: 1-800-1084-57788

Domestic Toll-Free: 1-800-1084-57788

Maya is powered by the country's only end-to-end digital payments company Maya Philippines, Inc. and Maya Bank, Inc. for digital banking services. Maya Philippines, Inc. and Maya Bank, Inc. are regulated by the Bangko Sentral ng Pilipinas.

www.bsp.gov.ph

Scan to download

the Maya app

the Maya app

© Copyright Maya 2022 All Rights Reserved.