While digital payments have exploded in popularity in recent years, recent studies have also shown that nearly half of Filipino adults still do not have a bank account. Considering that the majority of adults in the country own mobile phones and use the internet regularly, that gap is becoming less about having access to banking services and more about the lack of confidence and knowledge about the benefits of being banked, as many people still feel hesitant to keep their money in formal financial institutions.

To maximize the benefits of banking, you need more than just a bank account. Beyond this, you must feel confident about your bank’s ability to protect your money against fraud and be completely satisfied with the opportunities it offers to grow your funds. To know if your money is truly secure and your prospective bank is worthy of your trust, you need to ask the right questions. Start with the following:

Is Your Bank Licensed and Regulated by the BSP?

The first thing you should check is whether your chosen financial institution is supervised by the Bangko Sentral ng Pilipinas (BSP). A digital bank license from the BSP means that the institution operates under the highest regulatory standards, giving you confidence that your money is properly managed, monitored, and protected. Entrusting your funds to an online platform that lacks a BSP digital bank license puts your money at risk. This is because there are no guarantees that the said organization follows strict financial regulations or has your deposits covered by insurance in case of failure.

In contrast, a BSP-supervised financial institution like Maya adheres to strict rules that are designed to safeguard your funds. Plus, keeping your money in a digital bank that has acquired a license from the BSP means your deposits are insured by the Philippine Deposit Insurance Corporation (PDIC) for up to PHP 1,000,000 per depositor. You can feel confident that you’re protected, even in worst-case scenarios.

Does Your Bank Follow Global Security Standards?

Not all financial institutions operate at the same level of security. Global certifications serve as proof that a bank is serious about protecting your data and transactions. Without them, your personal information may be vulnerable to cyberattacks. Maya goes the extra mile by being PCI-DSS compliant, a global standard for handling cardholder data. On top of that, it holds ISO 27001 certification for information security and ISO 27701 for data privacy. These certifications mean your information is managed under the highest international standards, giving you an extra layer of assurance every time you use the services and products of the #1 digital bank in the Philippines.

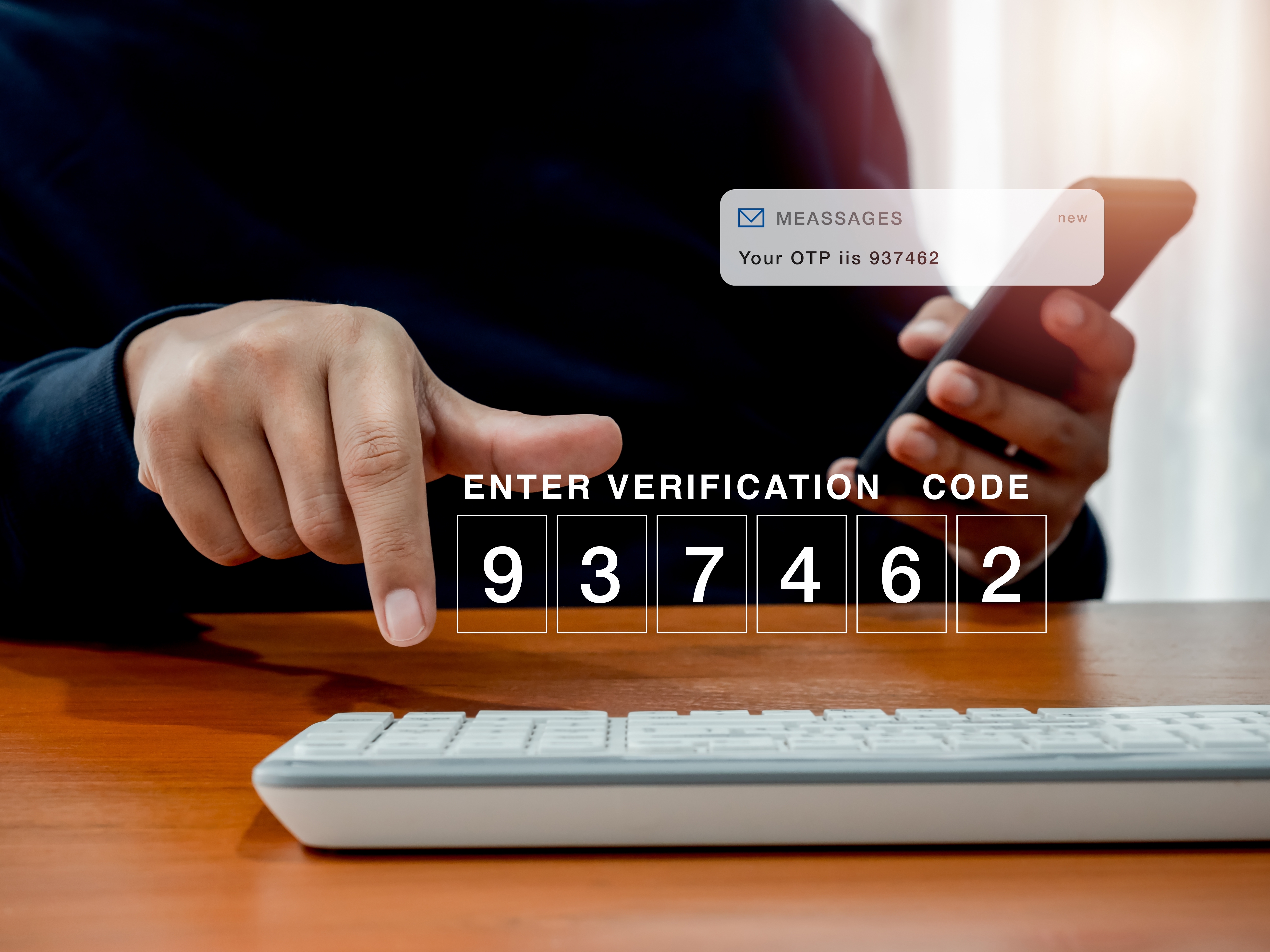

Can You Control How and Where Your Account Is Accessed?

Convenience matters, but so does control. You want to know that your account isn’t easily compromised if your device falls into the wrong hands. Maya addresses this by allowing login on only one device at a time, reducing the risk of unauthorized access. You can also choose between password or biometric login, including face or fingerprint recognition, for stronger authentication. Large transactions, like transfers to other banks or loan applications, are locked behind a one-time password (OTP), so even if someone has your phone, they can’t easily move your money. And if the wrong OTP is entered too many times, the feature is disabled for 24 hours to add another protective layer.

Does Your Bank Actively Protect You from Fraud and Scams?

The rise of phishing and online scams makes it crucial for banks to stay ahead of fraudsters. If your bank only reacts after a problem has already happened, that’s not real protection. Maya continuously monitors fraud and cyberattacks 24/7 using globally recognized tools, which means threats are being addressed even before you notice them. At the same time, Maya runs scam awareness initiatives to educate users about common tactics used by fraudsters. This way, you’re also empowered with knowledge to avoid falling victim in the first place.

Is It Easy to Reach Your Bank in an Emergency?

Imagine losing your phone or noticing suspicious activity on your account. In such cases, being able to quickly contact your bank can make all the difference. Maya provides dedicated support channels where you can immediately report emergencies. Whether your phone is stolen or you suspect someone else has your login credentials, you can act fast to protect your funds. Knowing that help is accessible right when you need it adds another layer of security to your banking experience.

Can Your Money Grow While Staying Safe?

Safety isn’t just about protecting money from theft. It’s also about ensuring your funds don’t sit idle and lose value to inflation. The best kind of financial safety includes growth opportunities. With Maya, you have several ways to make this happen. Maya Savings offers a base rate of 3.5% per annum, with the chance to boost it up to an industry-leading 15% just by actively using your Maya funds. If you’re working toward specific milestones, Personal Goals lets you set up to five different goal accounts. Each one of these earns up to 8% p.a. on balances of up to PHP 100,000, with tiered interest rates that start at 4% for the first PHP 20,000 and gradually increase up to 8% for amounts above PHP 80,000. For more structured saving, Time Deposit Plus allows you to lock in funds for 3, 6, or 12 months with rates of up to 6% p.a. These options mean your money doesn’t just stay safe; it grows while remaining secure under a BSP-regulated, PDIC-insured bank.

At the end of the day, keeping your money safe is about more than just having a place to deposit it. You need to know your bank is regulated, follows strict security standards, gives you control, and supports you when emergencies arise. Just as importantly, your chosen financial services provider should provide ways for your funds to grow without unnecessary risks. By choosing a digital bank like Maya, you can be confident that your hard-earned money is not only secure but also working harder for you.

You might also like

These Stories on Maya