The Philippines has a strong gig economy. For years now, Filipino freelancers have provided and continue to provide high-quality services to clients both here and abroad. In addition, more and more Filipinos are becoming more open to freelancing. The “work anytime, anywhere” set-up is definitely appealing, as is the potential for higher-than-average income.

To further add to the appeal of freelancing, there are also a lot of skills that you can learn online. You can then use these skills for a freelancing gig or start a small business. You can even monetize your social media following!

Of course, being a freelancer doesn’t mean you’re excused from government dues. Paying your contributions is your civic duty. In return, it affords you plenty of advantages such as the opportunity to take out loans for various purposes. For example, if you need money to buy a new house or renovate, you can take out a housing loan from Pag-IBIG. The SSS, meanwhile, offers maternity, sickness, and disability benefits, as well as a pension for seniors and retirees.

Luckily, it’s now easier than ever to settle these dues. Thanks to technology, you can now pay your taxes and government contributions online or through apps. To help you get started, here are a few tips:

Get Your Government IDs and Numbers First

The first thing you have to do to be able to pay your taxes and contributions is to get the corresponding government agency numbers. As a private citizen, you will need SSS, PhilHealth, and Pag-IBIG (HDMF) numbers (you don’t need a GSIS number because this is for government employees). These numbers are what tie your payments to your identity. You can also apply for the corresponding IDs at the same time, but the numbers are more important for the contributions.

Usually, employers can assist you in acquiring these numbers. However, if you immediately began your career as a freelancer, you need to apply on your own. Each agency has different requirements along with the application forms; make sure you have everything ready before you submit your application.

Note that there are already online facilities where you can apply for these numbers. Simply click the following links to proceed: SSS, Pag-IBIG, PhilHealth.

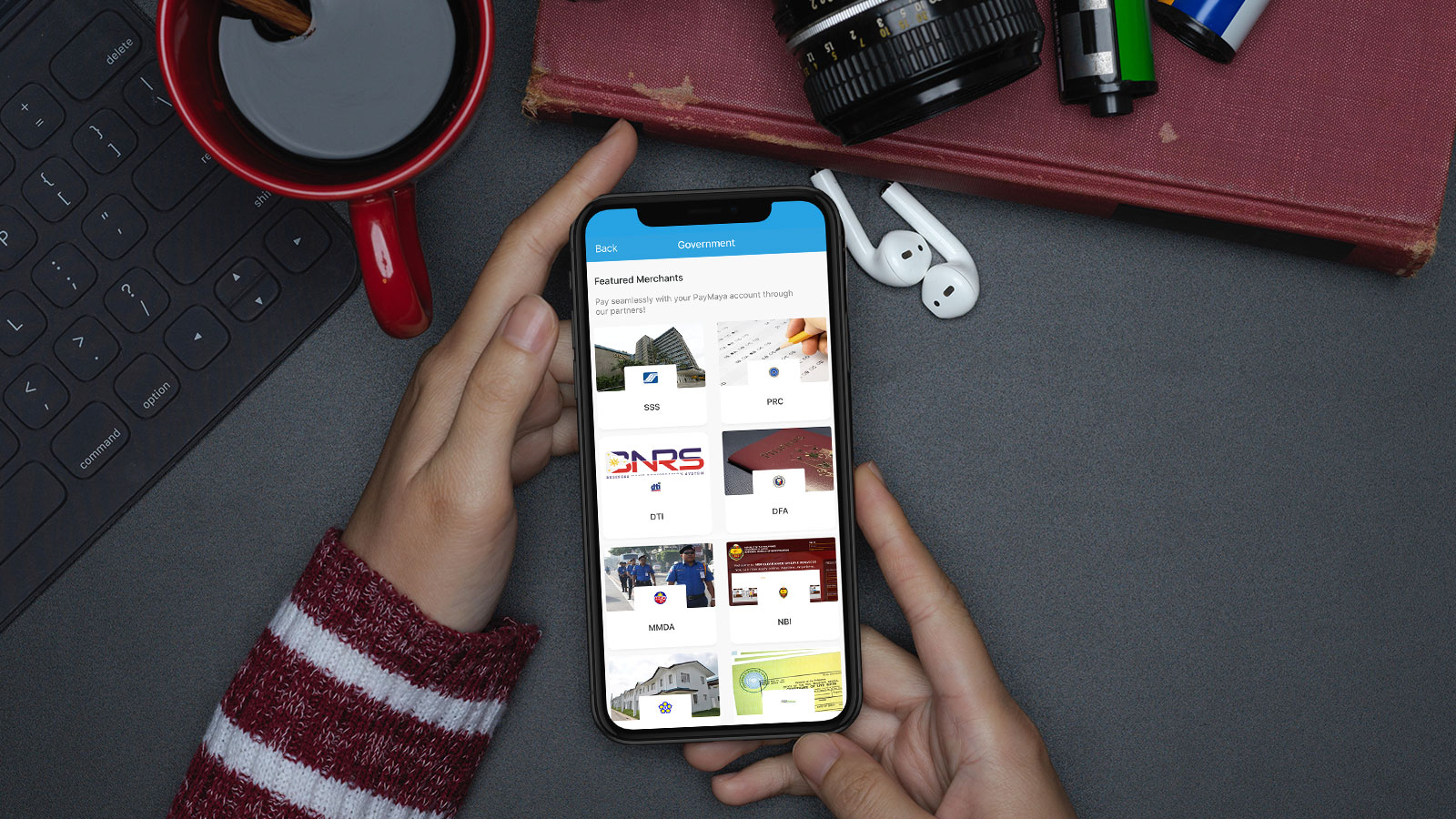

Get an E-Wallet Like maya.ph

The next step to settling your government payments through digital means is to download an e-wallet. maya.ph, for example, has partnerships with government agencies so it’s easier to pay your dues. Just open the app, tap the corresponding icon, input the required details, and pay.

Don’t forget to add money to your maya.ph account before the payment due date. Make sure that the details are correct, too, to ensure a smooth transaction and that your contributions are credited to your name properly.

Follow the Schedule

Speaking of due dates, there are different schedules for each government agency and you need to take note of them. For example, for SSS voluntary members, the due date for contributions is based on the last number of the SSS number.

Make sure to follow the deadline or you might end up paying considerable penalties. This is particularly true for loan payments. Just check online and set a reminder using your smartphone. If you can remember your favorite online stores and sale dates by heart, then you can remember the deadlines for your government contribution due dates!

Know How Much You Should Pay

The tax and government contributions you need to pay depends on how much you earn or the type of your membership. For SSS, freelancers qualify under self-employed members. The lowest contribution is Php 240 per month, while the highest is Php 2,400. The higher you contribute per month, the higher your MSC or monthly salary credit.

For Pag-IBIG, it’s based on your monthly income. If you earn only Php 1,000 to Php 1,500 per month, your contribution will be 1% of your income. If it’s over Php 1,500, then it will be 2%. Do note that the maximum income for self-employed Pag-IBIG members is Php 5,000. This means that even if you earn more than that, you’ll still only contribute Php 100. You can contribute an extra Php 100 to increase your savings, however, which can increase the amount you can borrow in the future.

Finally, for PhilHealth, the rate is 3% of the basic monthly salary as of 2020, and this will increase by 0.5% each year until the 5% limit is reached.

Do note that these rates change from time to time, so be diligent in checking updates from their respective websites or social media pages for announcements.

As you can see, it’s not all that difficult to pay your government dues. Thanks to technology, there are now much easier ways to accomplish everything. While you may need to visit the respective offices of these government agencies from time to time, you can pay all your dues online.

Follow these tips and do your part as a responsible citizen!

You might also like

These Stories on Bills Payment

4 min read

Dec 15, 2025 8:00:00 AM |

4 min read

Nov 5, 2025 8:00:00 AM |